Navigating the intricacies of travel requirements can often be as complex as planning the journey itself. For Filipinos traveling internationally, one significant aspect is understanding the Cebu Pacific Philippine Travel Tax. This obligatory levy, a cornerstone of Philippine government policy, directly impacts outbound travelers, making its proper understanding not just a matter of compliance but also efficient and stress-free travel.

For many, the travel tax remains a grey area, shrouded in questions about who pays, who is exempt, and how to manage payments and refunds. This comprehensive guide aims to demystify the Philippine Travel Tax, specifically as it pertains to Cebu Pacific passengers, offering clear insights and actionable advice to ensure a smoother pre-flight experience for every Filipino embarking on an international adventure.

What Exactly is the Cebu Pacific Philippine Travel Tax?

At its core, the Philippine Travel Tax (PH Travel Tax) is a government-imposed levy on individuals departing from the Philippines. Administered by the Tourism Infrastructure and Enterprise Zone Authority (TIEZA), this tax contributes to the nation’s tourism development and infrastructure. Understanding its fundamental nature is the first step toward seamlessly integrating it into your travel preparations, especially when flying with carriers like Cebu Pacific.

The Purpose of the Philippine Travel Tax

The levy plays a crucial role in bolstering the Philippines’ tourism sector. Funds collected through the travel tax are channeled towards various initiatives aimed at improving tourism infrastructure, promoting the country as a destination, and enhancing visitor experiences. This means that while it is an additional cost for travelers, it directly contributes to the growth and development of the very industry that facilitates global connections and cultural exchanges. For travelers with Cebu Pacific, this tax is simply a contribution to the national coffers for travel-related developments.

Who is Required to Pay the Cebu Pacific Philippine Travel Tax?

The obligation to pay the PH Travel Tax applies primarily to two categories of individuals:

- Philippine passport holders who are exiting the Philippines. This covers the vast majority of Filipino citizens undertaking international travel.

- Foreigners who have stayed in the Philippines for more than one year.

It is essential to note that foreign nationals whose stay in the Philippines is less than one year are exempt from paying this tax. For Filipino travelers, it is a near-universal requirement unless specific exemptions apply, which will be discussed in detail below. This direct obligation for most Filipino passport holders makes understanding the Cebu Pacific Travel Tax a critical component of their flight planning.

Navigating Cebu Pacific Philippine Travel Tax Exemptions for Filipinos

While the PH Travel Tax is widely applicable, the Philippine government, through TIEZA, provides a range of exemptions for specific categories of travelers. These exemptions are particularly relevant for Filipinos, ensuring that certain groups are not unduly burdened by the tax given their unique circumstances or roles. Being aware of these can save eligible travelers both time and money.

Cebu Pacific Philippine Travel Tax: Key Exemptions Relevant to Filipino Travelers

A significant number of exemptions directly benefit Filipino citizens. These include:

- Overseas Filipino Workers (OFWs): This is one of the most prominent exemptions, recognizing the vital contributions of OFWs to the Philippine economy.

- Filipino permanent residents abroad: If their stay in the Philippines is less than one year, they are exempt.

- Infants (2 years and below): Youngest travelers are not subject to the travel tax.

- Philippine Foreign Service Personnel: Those officially assigned abroad and their dependents are exempt.

- Officials and Employees of the Philippine Government, If traveling on official business, excluding Government-Owned and Controlled Corporations (GOCCs), are exempt.

- Bona-fide Students with approved scholarships: Those with scholarships approved by the appropriate government agency are also exempt.

These categories ensure that a substantial portion of Filipino travelers, especially those contributing to the national economy or holding specific governmental or educational roles, are exempt from the Cebu Pacific Travel Tax burden.

Special Cases: OFWs and Balikbayans with Cebu Pacific Philippine Travel Tax

The status of OFWs and Balikbayans often leads to specific questions regarding the travel tax. As mentioned, OFWs are generally exempt from this requirement. For Balikbayans, as provided under R.A. 6768, those whose stay in the Philippines is less than one (1) year are exempt. Additionally, family members of former Filipinos who are accompanying them are also exempt, as per R.A. 6768. These provisions underscore the government’s acknowledgment of the distinct ties and contributions of overseas Filipinos and their families. These individuals must be aware of their eligibility for exemption to avoid unnecessary payment of the Cebu Pacific Travel Tax.

Seamlessly Paying Your Cebu Pacific Philippine Travel Tax

One of the most convenient aspects of the Cebu Pacific Philippine Travel Tax for passengers is the integration of the payment process directly into the airline’s booking and management systems. This eliminates the need for separate trips to a TIEZA counter, streamlining the pre-flight procedures for travelers.

Paying Your Cebu Pacific Philippine Travel Tax During Flight Booking

The easiest way to pay the travel tax is at the time of booking your flight through the Cebu Pacific app. The process is designed to be straightforward:

- Initiate booking a flight on the Cebu Pacific app.

- During the booking process, you will be prompted to pay for the tax. To ensure a smooth airport experience and avoid potentially long lines, it is advisable to select the designated payment option.

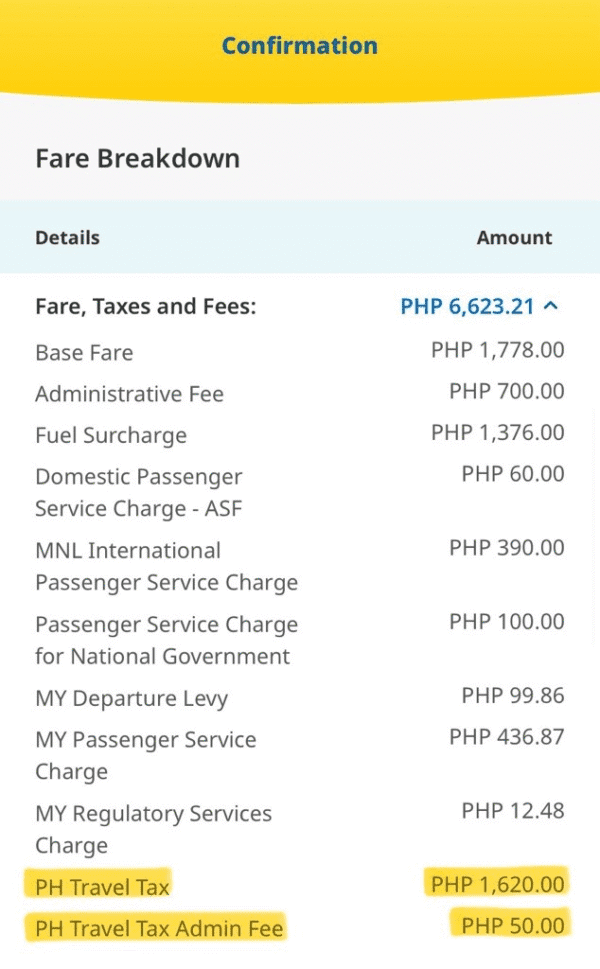

- Upon successful payment, the Cebu Pacific Philippine Travel Tax and any associated administrative fees (e.g., PHP 50.00 for PH Travel Tax Admin Fee) will be reflected in the “Fare Breakdown” section on the confirmation page. This immediate confirmation provides peace of mind that your Cebu Pacific Travel Tax obligation has been met.

How to Pay the Cebu Pacific Philippine Travel Tax After Booking

For travelers who might have overlooked paying the travel tax during their initial booking, Cebu Pacific offers a convenient option to do so afterward through their “Manage Booking” feature. This flexibility is particularly useful for those who might have been unsure about their travel tax status or forgot to include it in their initial transaction.

- Log in to your MyCebuPacific account.

- Navigate to “My Bookings” within your account.

- Scroll through your bookings to locate the relevant flight and tap “Manage”. (If your booking is not visible, it will need to be added to your account first).

- Within the booking details, scroll down until you find and tap the “Philippine Travel Tax” box.

- Tick the appropriate box and proceed with the payment for the PH Travel Tax.

- Similar to paying at the time of booking, after successful payment, the tax will be reflected in the “Fare Breakdown” on the confirmation page of your booking. This ensures that your Cebu Pacific Travel Tax payment is accurately recorded against your flight.

Cebu Pacific Philippine Travel Tax Refunds: What Filipinos Need to Know

While paying the Cebu Pacific Philippine Travel Tax is an important step, understanding the refund process is equally crucial, especially for Filipinos whose travel plans might change or who are eligible for exemptions but mistakenly paid the tax. Cebu Pacific outlines clear guidelines for requesting refunds.

General Guidelines for Cebu Pacific Philippine Travel Tax Refunds

Several general principles govern the refund of the PH Travel Tax:

- Timeliness: Travelers must claim their refund of the PH Travel Tax within two (2) years from the date of payment.

- Processing Fee: A processing fee of PHP 300 is typically applied when requesting a travel tax refund, though this fee is subject to change.

- Travel Fund Exclusion: According to government regulations, the travel tax cannot be credited to your Cebu Pacific Travel Fund; it can only be refunded.

These guidelines provide a framework for all refund requests related to the Cebu Pacific Travel Tax.

Cebu Pacific Philippine Travel Tax Refunds for Disrupted Flights or No-Shows

When travel plans are unexpectedly altered due to flight disruptions or a traveler misses their flight (no-show) or forfeits a booking, the process for refunding the PH Travel Tax varies slightly:

- Disrupted Flights: If your flight is disrupted and you select the refund option, the value of all unused fees, including the PH Travel Tax, will be refunded, provided it remains unused. If you opted for a Travel Fund, you will need to chat with a Live Agent via the Cebu Pacific app or website, as the travel tax itself cannot be stored in a Travel Fund.

- No-Show or Forfeited Booking: For instances where the travel tax was unused due to a missed flight or a forfeited booking, a refund request must be initiated on the Cebu Pacific website. Accessing “Manage Booking” requires a MyCebuPacific account. The steps involve logging in, navigating to “Manage Booking,” selecting the relevant booking, clicking “Request for Refund,” and then choosing “Refund Government Taxes”. Crucially, the “Request for Refund” box will only be visible once the booking’s departure date has passed. This structured approach ensures that eligible Filipinos can recover their Cebu Pacific Travel Tax even under unforeseen circumstances.

Specific Cebu Pacific Philippine Travel Tax Refund Scenarios for OFWs

Overseas Filipino Workers (OFWs) who mistakenly pay the PH Travel Tax, despite being exempt, are eligible for a refund. This is contingent upon providing a Tax Exemption Certificate or other valid requirements. The refund request process for OFWs follows the same steps as those for no-shows or forfeited bookings: logging into MyCebuPacific, accessing “Manage Booking,” and initiating a “Refund Government Taxes” request on the Cebu Pacific website. Again, the “Request for Refund” box will only appear after the departure date has passed. This provision ensures that OFWs, a key group for the Philippine economy, are not penalized by accidental payments of the Cebu Pacific Travel Tax.

Refunds for Cebu Pacific Philippine Travel Tax Paid Offline

For travelers who paid the PH Travel Tax at a Cebu Pacific Ticketing Office or an Airport Counter, the refund procedure depends on the time elapsed since payment:

- Within 26 Days: If less than 26 days have passed since the payment date, Cebu Pacific will process the refund directly.

- 26 Days or More: If 26 days or more have passed, the process requires more steps. The traveler must first request a “TIEZA 353 Certification” from Cebu Pacific. This can be done by contacting a live agent via chat. Once this certification is obtained, the traveler must file the refund request directly through TIEZA, providing all required documents. This dual process for offline payments ensures that even manual payments of the Cebu Pacific Travel Tax can be reconciled.

The Cebu Pacific Philippine Travel Tax is more than just a fee; it is a vital contribution to the Philippines’ tourism landscape and an unavoidable part of international travel for many Filipinos. By understanding who is required to pay, who qualifies for exemptions, and the clear, convenient methods for both payment and refund provided by Cebu Pacific, Filipino travelers can navigate this aspect of their journey with confidence and ease.

Embracing these guidelines enables individuals to focus on the excitement of their upcoming adventures, knowing that their travel tax obligations are handled efficiently and accurately. Whether planning your next overseas trip or reflecting on past voyages, mastering the nuances of the Philippine Travel Tax, primarily through Cebu Pacific’s integrated system, truly empowers a smoother, more informed, and ultimately, more enjoyable travel experience.

Frequently Asked Questions about Cebu Pacific Philippine Travel Tax Payment

What is the Philippine Travel Tax (PH Travel Tax)?

The Philippine Travel Tax is a fee imposed by the Philippine government, managed by the Tourism Infrastructure and Enterprise Zone Authority (TIEZA), on individuals departing the country.

Who is required to pay the PH Travel Tax?

The PH Travel Tax applies to Philippine passport holders exiting the Philippines and foreigners who have stayed in the Philippines for more than one year. Foreign nationals staying in the country for less than a year are exempt from this tax.

How can I pay the Cebu Pacific Philippine Travel Tax when booking flights?

You can conveniently pay the PH Travel Tax when you book a flight through the Cebu Pacific app or website. During the booking process, you will have the option to include tax, helping you avoid queues at the airport. Suppose you forget to pay at the time of booking. In that case, you can add it later by logging into your MyCebuPacific account, accessing “My Bookings,” selecting your flight, and tapping the “Philippine Travel Tax” box to proceed with payment.

Can the Cebu Pacific Philippine Travel Tax be stored in my Travel Fund or transferred?

No, according to government regulations, the travel tax cannot be stored in your Travel Fund. However, if you rebook your flight, the travel tax will be carried over to your new booking.

What are the general guidelines for refunding the PH Travel Tax?

You must claim your refund for the PH Travel Tax within two years from the payment date. A processing fee of PHP 300 applies, which is subject to change.

How can I obtain a refund for the Philippine Travel Tax if my flight was cancelled or delayed?

If your flight was disrupted and you selected the “Refund” option, the value of all unused fees, including the PH Travel Tax, will be refunded. If you choose the “Travel Fund” option, you need to chat with a Live Agent via the Cebu Pacific app or website, as the travel tax cannot be stored in a Travel Fund.

What is the refund process if I missed my flight or forfeited my booking and didn’t use the travel tax?

If you missed your flight (no-show) or forfeited your booking, you can request a refund for the travel tax on the Cebu Pacific website. Log in to your MyCebuPacific account, go to “Manage Booking,” select the relevant booking (ensure it’s past its departure date), click “Request for Refund,” and then “Refund Government Taxes.”

What if I am an Overseas Filipino Worker (OFW) who accidentally paid the PH Travel Tax?

OFWs returning to their country of work who accidentally paid the tax can get a refund, provided they have a Tax Exemption Certificate or other valid requirements. The refund request can be made on the Cebu Pacific website via your MyCebuPacific account, following the same steps as for missed flights or forfeited bookings (Manage Booking -> Request for Refund -> Refund Government Taxes). If the payment was made at a Ticketing Office or Airport Counter, Cebu Pacific processes refunds for payments made within the last 26 days. If 26 days or more have passed, you must request a TIEZA 353 Certification from Cebu Pacific and file the refund request directly with TIEZA.

For more information, booking, and information, head to the Cebu Pacific Air Official Website or call the reservation hotlines (02) 8702 0888 or (032) 230-8888.

Click here to book. Promo flight info, including origin, destination, and flight rates, as announced from the Cebu Pacific Seat Sale page. Here is how to book online.